State and Local taxes are estimated by multiplying the federal taxable gross by a percentage that you input. FICA Social Security Tax and Medicare are calculated based on the percentage of your Gross Pay. Federal taxes are calculated using tables from IRS Publication 15. Enter your Gross Pay for monthly, semi-monthly, biweekly, or weekly pay periods.

Use the worksheet corresponding to the W-4 form (old = 2019 or older). Most of what you need to know is on there.

The amount of catch-up contribution is $6,5. You may now make an additional pre-tax contribution to your plan.

If your plan rules allow, the law gives you the opportunity to make "catch-up" contributions to your retirement plan. Most Americans are required to pay federal income taxes, but the amount you owe.

#Paycheck calculator free

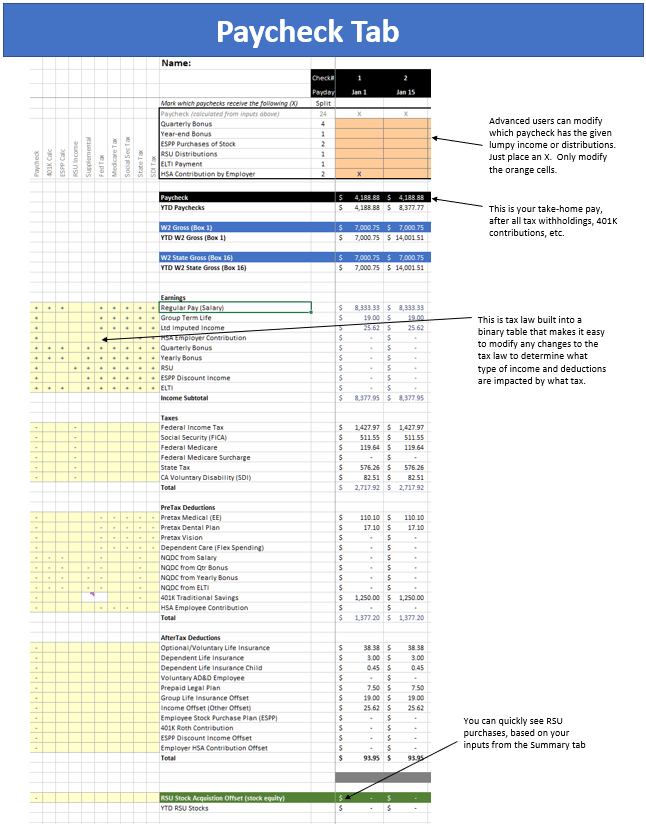

If you will be age 50 or older during the calendar year, and reach the plan or IRS limit, you may receive a significant benefit. Estimate your tax refund with H&R Blocks free income tax calculator. (Note that other pre-tax benefits could lower your taxable income further.) After-tax contributions are those you make from your net pay, that is, your income after taxes. For example, if you made $30,000 last year, and put $3,000 in your retirement plan account on a pre-tax basis, your taxable income for the year would have been $27,000. Of course, taxes will be due when you withdraw money from your Plan. Over time, this tax advantage can make a big difference, and can be a major factor in your account balance at retirement. Your earnings can compound and have the potential to grow more without taxes taking a portion each year. Current income taxes on your before-tax contributions and all of your investment earnings are deferred as long as your money remains in the Plan. This area indicates the amount of your contribution and an example of how your take home pay could change if your contribution is made pre-tax (deducted from your paycheck before income taxes are calculated). The calculation is based on the 2022 tax brackets and the new W-4, which, in 2020, has had its first major. This calculator is intended for use by U.S. It can also be used to help fill steps 3 and 4 of a W-4 form. If you contribute a portion of your salary on a dollar deferral basis, you can convert your dollar deferral portion to a percentage for purposes of this calculator. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

0 kommentar(er)

0 kommentar(er)